Payment Processing Solutions Market Top Trends and industry overview to watch for in 2033 | CAGR of 12%

Market Size And Growth

The payment processing solutions market refers to the industry that provides services and technologies for facilitating electronic transactions. It includes a wide range of players such as payment processors, merchant acquirers, payment gateways, and mobile wallet providers. This market has experienced significant growth in recent years, driven by the increasing adoption of digital payments and the rise of e-commerce.

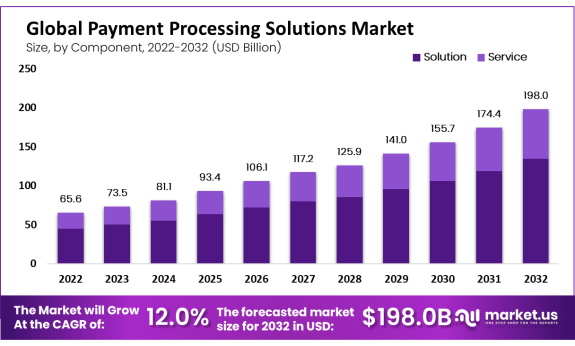

The Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032 from USD 65.6 Billion in 2022, growing at a CAGR of 12.00% during the forecast period from 2023 to 2032.

One key trend in this market is the shift towards mobile payments, with consumers increasingly opting to make purchases using their smartphones or other mobile devices. As a result, there has been a growing demand for mobile payment solutions that provide convenience and security. In addition to traditional card-based payments, these solutions may include options like contactless payments or digital wallets.

Another important aspect of the payment processing solutions market is the focus on enhancing security measures. With cyber threats becoming more sophisticated, companies are investing in technologies such as tokenization and encryption to protect sensitive customer data during transactions. Additionally, compliance with data protection regulations such as GDPR has become crucial for businesses operating in this space.

Request For Sample Report Here: https://market.us/report/payment-processing-solutions-market/request-sample

Market Key Players:

Adyen

Alipay

Amazon Payments, Inc.

Authorize.Net

PayPal Holdings Inc.

PayU

SecurePay

Stripe, Inc.

Apple Inc. (Apple Pay)

Alphabet (Google Pay)

Other Key Players

Key Market Segments:

Based on Component

Solution

Service

Based on the Deployment Mode

Credit card

Debit card

E-wallet

Automated Clearing House (ACH)

Others

Based on Industry Vertical

BFSI

Government & Utilities

It & Telecom

Healthcare

Retail & E-commerce

Media & Entertainment

Travel & Hospitality

Others

Directly Purchase a copy of the report | Quick Delivery Available - buy: https://market.us/purchase-report/?report_id=99255

Drivers of the Payment Processing Solutions Market:

Growing Digital Payments: The increasing preference for digital payment methods, such as credit/debit cards, mobile wallets, and online payment platforms, is a major driver of the payment processing solutions market. The convenience, speed, and security offered by digital payments are fueling their adoption globally.Rise of E-commerce: The booming e-commerce industry is driving the demand for payment processing solutions. As more consumers shop online, businesses need reliable and secure payment processing systems to facilitate transactions and ensure a seamless customer experience.Contactless Payments: The COVID-19 pandemic has accelerated the adoption of contactless payments to reduce physical contact. Contactless payment technologies, including NFC-enabled cards and mobile wallets, are driving the growth of payment processing solutions that support these methods.Mobile Payment Apps: The widespread use of smartphones and the availability of mobile payment apps have contributed to the growth of the payment processing solutions market. Consumers are increasingly using their mobile devices to make payments, driving the demand for secure and user-friendly mobile payment solutions.

Restraints of the Payment Processing Solutions Market:

Security Concerns: With the increasing volume of digital transactions, security and data privacy concerns are a significant restraint for the payment processing solutions market. Businesses and consumers require robust security measures to protect sensitive financial information and prevent fraud.Regulatory Compliance: The payment processing industry is subject to numerous regulations and compliance requirements, such as the Payment Card Industry Data Security Standard (PCI DSS). Adhering to these regulations can be complex and challenging, particularly for small businesses, which may hinder market growth.

Opportunities in the Payment Processing Solutions Market:

Emerging Markets: There are significant opportunities for payment processing solutions in emerging markets where digital payment adoption is still in its early stages. As these markets experience economic growth and increased smartphone penetration, the demand for payment processing solutions is expected to rise.Integration with Emerging Technologies: Integration with emerging technologies like artificial intelligence (AI), machine learning (ML), and blockchain presents opportunities for payment processing solutions. AI and ML can enhance fraud detection and prevention, while blockchain can provide secure and transparent transaction processing.

Challenges in the Payment Processing Solutions Market:

Intense Competition: The payment processing solutions market is highly competitive, with numerous players offering similar services. Providers must differentiate themselves through innovative features, reliability, security, and competitive pricing to stand out in a crowded market.Changing Consumer Expectations: Consumers' expectations regarding payment convenience, speed, and security are continuously evolving. Payment processors must keep pace with these expectations by offering seamless and user-friendly experiences to retain customers.Technological Advancements: The rapid pace of technological advancements presents both opportunities and challenges for payment processing solutions. Providers must keep up with emerging technologies, such as biometrics and tokenization, to stay competitive and meet evolving customer demands.

Make an inquiry before picking up this report @ https://market.us/report/payment-processing-solutions-market/#inquiry

Emerging Technologies and Changing Consumer Behavior

Emerging technologies have significantly impacted consumer behavior in the payment processing solutions market. The rise of mobile payment options, such as digital wallets and contactless payments, has transformed the way consumers make transactions. These technologies offer convenience, speed, and enhanced security compared to traditional payment methods like cash or credit cards. As a result, consumer preferences have shifted towards these emerging technologies, leading to a decline in the usage of physical currency and traditional card-based payments.

Additionally, advancements in artificial intelligence (AI) and machine learning have revolutionized customer interactions and personalized experiences within the payment processing industry. AI-powered chatbots and virtual assistants are now being used by businesses to provide instant support and streamline customer service processes. Consumers are increasingly comfortable with conversational interfaces when it comes to making inquiries about their accounts or resolving disputes.

Contact:

Global Business Development Team – Market.us

Market.us (Powered by Prudour Pvt. Ltd.)

Send Email: inquiry@market.us

Address: 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

Tel: +1 718 618 4351

Website: https://market.us