direct-to-consumer (dtc) pet food market

e-waste management system market

custom shoes market

Payment Processing Solutions Market Top Trends and industry overview to watch for in 2033 | CAGR of 12%

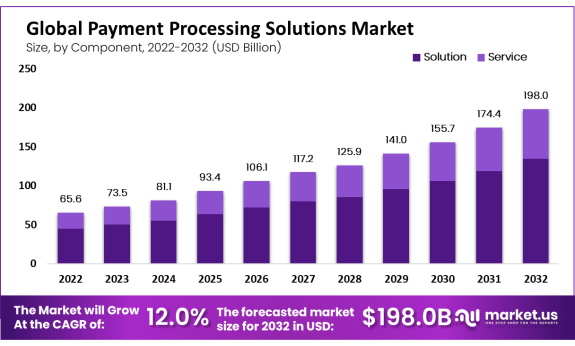

Market Size And Growth

The payment processing solutions market refers to the industry that provides services and technologies for facilitating electronic transactions. It includes a wide range of players such as payment processors, merchant acquirers, payment gateways, and mobile wallet providers. This market has experienced significant growth in recent years, driven by the increasing adoption of digital payments and the rise of e-commerce.

The Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032 from USD 65.6 Billion in 2022, growing at a CAGR of 12.00% during the forecast period from 2023 to 2032.

One key trend in this market is the shift towards mobile payments, with consumers increasingly opting to make purchases using their smartphones or other mobile devices. As a result, there has been a growing demand for mobile payment solutions that provide convenience and security. In addition to traditional card-based payments, these solutions may include options like contactless payments or digital wallets.

Another important aspect of the payment processing solutions market is the focus on enhancing security measures. With cyber threats becoming more sophisticated, companies are investing in technologies such as tokenization and encryption to protect sensitive customer data during transactions. Additionally, compliance with data protection regulations such as GDPR has become crucial for businesses operating in this space.

Request For Sample Report Here: https://market.us/report/payment-processing-solutions-market/request-sample

Show more

api management market

electric toothbrush market

Subscription levels

No subscription levels